As we hop, skip and jump (hopefully not crawl) into 2022, there is a feeling of urgency and commitment coming from loyalty program managers to make their programs more financially sustainable and viable.

For me, this is a priority for every program I work with.

Zone One of the Seven Zones of Loyalty Program Performance and the one to always lead with, is the program needs to be profitable and sustainable for the business. (The other Six Zones can be found in this free ‘purple-paper’).

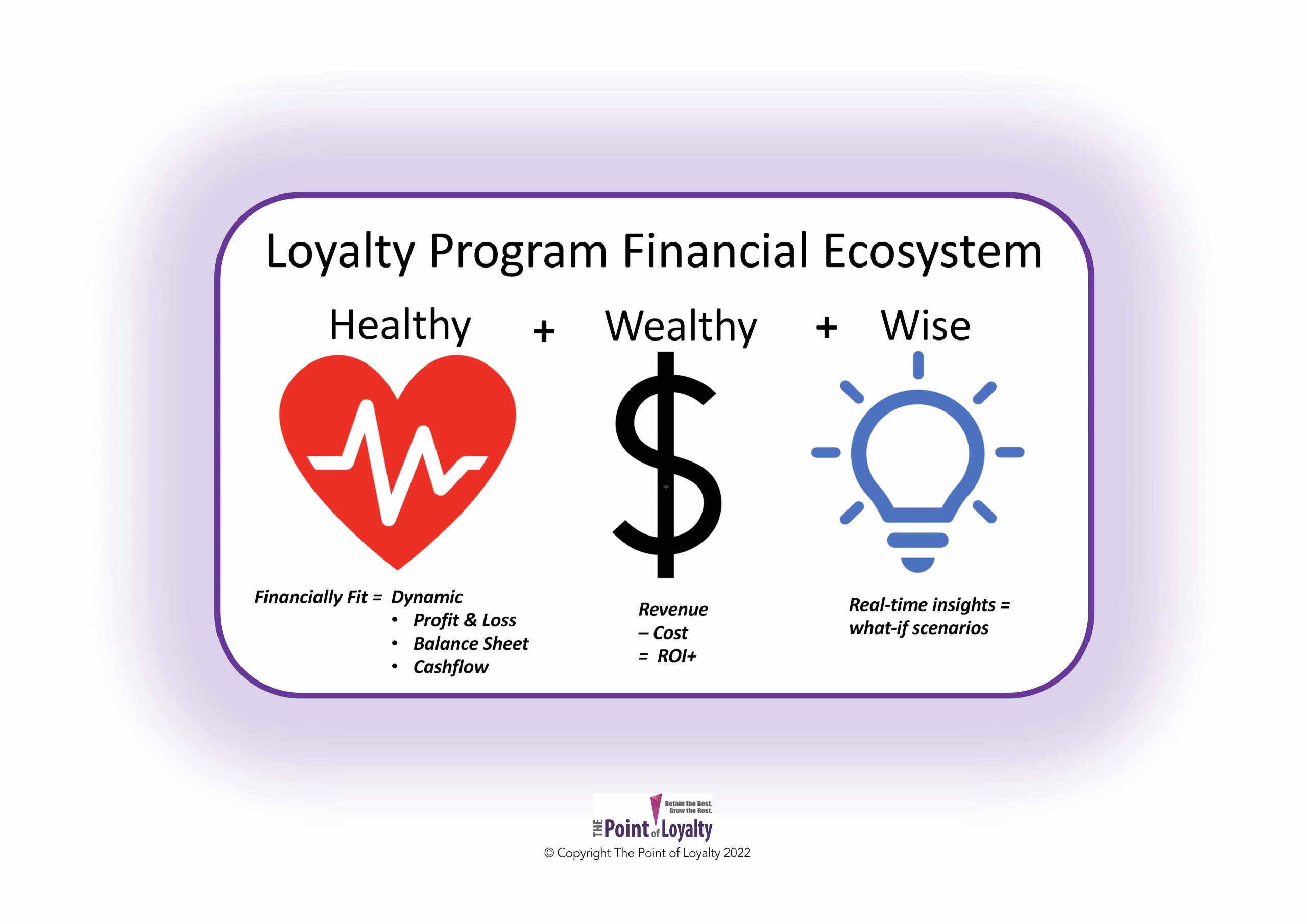

To deliver to Zone One, the loyalty program financial ecosystem needs to be healthy, wealthy, and wise.

Healthy

A fit and healthy loyalty program financial ecosystem has dynamic and connected profit and loss, balance sheet and cash flow models for real-time insights.

The financial models need to continuously ascertain the:

- Revenue

- Costs

- Profitability

- Balance sheet implications

- Cash flow effects of the loyalty program

‘Dynamic’ means as you change any of the variable program success levers, those impacting revenue and expenses, the financial model provides real-time updates to the financial outcomes connected to the profit and loss (EBITDA), the balance sheet (Net Assets) and Cash flow (Net operating cash).

Is your loyalty program financial ecosystem healthy?

Wealthy

The loyalty program financial model provides the ROI indicators for your loyalty program to be an asset of growth

A ‘wealthy’ loyalty program is a program performing profitably over the long-term and proving its value to the business as an asset of growth.

The financial ecosystem of the program needs to co-exist with the rest of the business financials proving it is a wealth creator for the host business.

Is your loyalty program financial ecosystem wealthy?

Wise

Real time insights need to be available to improve the financial well-being of the program

A ‘wise’ loyalty program financial ecosystem provides the insights to act at speed.

It allows for simple ‘what-if’ scenarios.

What if scenario’s

‘What if’ scenario planning is powerful in directing your loyalty program strategy.

Feed your loyalty program financial model with ‘what-if’ inputs (drivers of success) to reveal the real-time impact on success.

What if you changed (increased/decreased) the:

- Volume of members

- Activity rates

- Spend value and frequency

- Engagement with external partners (if relevant)

- Redemption of rewards

- Policies of expiry

- Cost of rewards

(There are many other inputs to consider)

How would these impact

- Achieving revenue targets

- Reducing cost metrics

- Enhancing profitability

- Understanding liability management and

- Managing cash flow outcomes

Is your loyalty program financial ecosystem wise?

Building a healthy, wealthy, and wise loyalty program financial ecosystem in 2022

A successful loyalty program is dependent on the ‘fitness’ of the financial models supporting the program.

New strategies, changes to program propositions or new costs can be tested in a financial model to assess and support executive decisions.

Like starting a new personal fitness regime, a ‘loyalty program financial fitness’ regime needs to assess the current situation.

Start with a Loyalty Program Financial Fitness Assessment

To help you with this, we have a simple (and free) Loyalty Program Financial Fitness Assessment.

If you need some guidance or an independent assessment of the financial fitness of your loyalty program, please email adam@thepointofloyalty.com.au for our free Loyalty Program Financial Fitness Assessment.

Our experience and expertise have been gained from over a decade in accounting for loyalty programs through tailored and program specific profit and loss, cash-flow, and balance sheet reporting.

These have been developed for major airlines, retail programs and B2B wholesaler programs. The financial models manage program structures of all types of programs from points earn and burn, credits, discounts, cashback, and gift cards, tiered and flat programs.

The goal is to have a healthy, wealthy, and wise loyalty program fit for 2022 and ready to help you make strategic decisions to deliver a positive financial difference for your program and your business.

Request your free Loyalty Program Financial Fitness Assessment (adam@thepointofloyalty.com.au)

Have a financially fit loyalty year!