- If your answer is YES, read further to add value to your decision.

- If your answer is NO, don’t read further (unless you want to open your mind to the possibilities).

- If the answer is NOT SURE, read further to add insights to your decision-making process.

If you are reading further (this is a long(ish) article), here are two perspectives to consider:

1. External: 11 market-place proof points of loyalty program popularity

2. Internal: Clarity (with a model) on six reasons why brands invest in loyalty programs

1. External: 11 market-place proof points of loyalty program popularity (Australia focused)

Here is my point of view (it might be biased) of some of the external proof points which provide insights on why loyalty programs (as defined[1]) in Australia are going through a period of popularity.

(This is not an exhaustive list and the 11 indicators are in no particular order, although if it was ranked, I’d say number 1 would be ranked 1 and number 10 arguably close to number one).

- Revenue and performance are being reported: ASX listed companies who invest in loyalty and rewards programs are highlighting their performance in their annual reports. A few examples are below from 2020 reports:

Adairs Retail Group’s Linen Lovers: “Over 800,000 paid members ($19.95 for 2 years) accounting for 75% of Adairs sales.”[2]

Super Retail Group: “6.6 million active club members across four core brands (Supercheap Auto, Rebel, BCF and Macpac). Contributed 59 per cent of total sales.”[3]

MYER: MYER one: “Five million membership cards in circulation. MYER one customers are highly engaged in the program, accounting for almost two thirds of Myer sales.”[4]

Woolworths: Everyday Rewards: “In Loyalty & FinTech, Everyday Rewards members grew by 5.5% to 12.3 million members by the end of June. In-store scan rates at Woolworths Supermarkets increased to 49.6% reflecting stronger member engagement.”[5]

Endeavour Drinks: Dan Murphys – My Dan’s: “My Dan’s loyalty program also continues to resonate with customers, with members reaching a record 4.5 million at the end of the year, an increase of 29% on the prior year.”[6]

API: Priceline: Priceline Sisterclub: “Priceline has recently relaunched the Sister Club, which remains Australia’s largest health & beauty loyalty program. The changes to the platform are designed to grow sales and visitations by rewarding our most loyal customers.“[7]

Qantas: “Qantas Loyalty reported an Underlying EBIT of $341 million, after reporting a record first half of 2019/20. It provided an important source of diversified earnings and positive cash flow as the Group’s airlines moved into hibernation.”[8]

2. Refreshing and rebranding: The big programs (by membership) are refreshing and rebranding - flybuys brand repositioning to “give a flybuys – take more” ; Woolworths Rewards to everyday rewards; Priceline Sisterclub (revitalised proposition) and numerous others in different ways.

3. Birth of new: New programs are being released in 2021 such as Adore Beauty proving it’s never too late to launch a loyalty program. (Article about this here)

4. Recruitment: Dedicated roles to customer loyalty/loyalty programs are being invested in (more than I have seen in ages). They come and go quickly - here’s one example here

5. Regulatory review: Loyalty programs have been through a period of review (ACCC in 2019) and have come out stronger and wiser.

6. Technology: The technology providers are offering bespoke ‘loyalty management systems’ from enterprise level to SAAS (too many to mention).

7. Content: Consultants are creating content (podcasts – The Loyalty Podcast and Let’s talk Loyalty, a book - Loyalty Programs – The Complete Guide and dedicated research – For Love or Money™ (shameless plug).

8. Education: Advancing the skills of loyalty professionals with bespoke loyalty program courses being offered (ADMA, ALA and The Loyalty Academy in the US).

9. Events: The community are connecting and the Australian Loyalty Association is enabling a community of 'loyalty lovers'.

10. The ever-present desire for data. The cookie is crumbling and this is creating a catalyst of interest in “known, controlled and owned data” - which a loyalty program provides. Interesting webinar here from Cheetah Digital - “Why loyalty is the key to surviving the death of the cookie”

11. Programs are pervasive in the consumer landscape: 88% of Australian adults over the age of 18 are a member of at least one program, with an average of 4.4 (this has remained stable over the past 8 years (sneak-peak insight from the latest Love or Money™ 2021 – to be released soon).

Phew… and so now I have convinced myself even more!

2. Internal: Clarity on six reasons why brands invest in loyalty programs

The external examples above provide support and strength to the success of loyalty programs in whatever form or function they exist.

However, internal success is only proven when a brand can design and deliver a program proposition to their customers to achieve the outcomes desired and that’s where we answer the question…

Do you really need a loyalty program?

If you have read this far, then you are open-minded to the different reasons for a loyalty program or problems a program can solve.

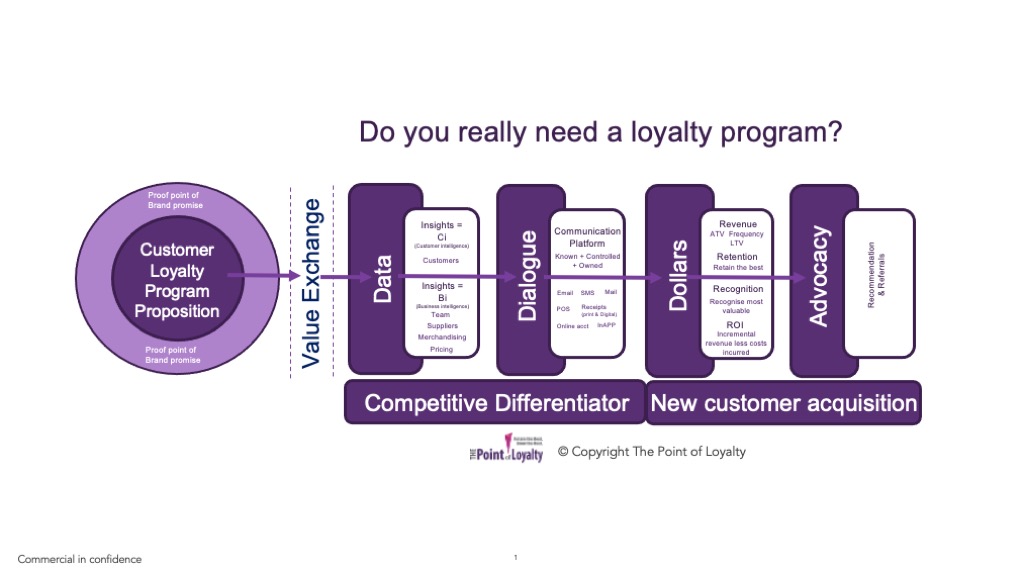

Here are 6 reasons in sequence (as per model):

- Data

- Dialogue

- Dollars

- Advocacy

- Competitive differentiator

- New Customer acquisition

Arguably and from my experience the most common need identified for a program is DATA.

It is one word with some many layers and levers.

Let’s focus on your customers’ data.

Their personal data (name, DOB and other demography), communication contact details, purchase behaviour data, belief and sentiment data.

This is the input data from which insights are derived or inferred for deeper intelligence.

1. Data: A loyalty program proposition is a value exchange (give to get) for your customers’ data.

Customer data provides the opportunity for Intelligence:

- Ci: Customer intelligence = know your customers. The data gained from the loyalty program value exchange with customers provides brands with the opportunity to identify deeper insights directly linked to their customers – know your customers, their behaviours and beliefs.

These known insights are used in a myriad of ways from value segmentation to persona profiling providing opportunities to take action (see below - From dialogue to dollars).

- Bi: Business intelligence = build your business. The data gained from the loyalty program value exchange with customers provides brands with the opportunity to identify insights for building a better business.

These known insights are used as value adding to supplier relationships with relevant data sharing, merchandising insights, pricing strategies and team interaction with customers. Not to forget the derived revenue from partners tapping into the program data and contactable base.

In summary: Loyalty program data = know your customers, build your business.

2. Dialogue: Known customer data provides the opportunity for dynamic customer dialogue

A known customer communication platform. The data generated from the loyalty program value exchange provides the opportunity to drive dynamic (real-time) and personalised communications with customers.

Access to multiple consented and contactable channels of communication avoids channel fatigue and increases the opportunity for brands to have direct control to shift and lift purchase behaviour which leads to ‘dollars’ (hopefully more of these).

3. Dollars: From dialogue to dollars

The model progresses from loyalty program proposition providing a value exchange for data, which when used intelligently, leads to dynamic and personalised dialogue, which aims to drive dollars.

'Dollars' have multiple meanings:

- Dollars are the incremental revenue the business gains through increasing transaction value (spend more), frequency of purchase (purchase more often) and more profitable products (purchase products with more margin).

- Dollars are the accumulated lifetime value of customers – past and predictive.

- Dollars are the measures to determine customer retention (retain the best) and recognition (recognise the most valuable customers)

- Dollars are the return on loyalty investment. Incremental revenue the program delivers less the costs incurred to facilitate the program.

Data + Dialogue = Dollars are three great reasons for a program. But wait, there’s more…

4. Advocacy

By no means the end of the road, rather a desired outcome of a program is to drive advocacy – be it through measured sentiment eg NPS or specific deliverables eg referrals. A program plays its part to influence advocacy when it is well executed with moments of magic (some call it surprise and delight) to lift the ordinary to the extra-ordinary and drive talkability and love for the program and by connection to the brand. (So much more can be said about this but not in this article).

5. Competitive differentiator

It’s not often brands I work with, highlight the need for a program to help them differentiate in the market, as a priority. However, a carefully crafted and curated program that leverages a brand (eg Mecca Beauty Loop) can create a point of difference for a brand.

6. Customer acquisition

Loyalty programs (as defined) are there to recognise and reward the customers you already have acquired. However, they are still a strategy to attract customers to a brand for the first time and once in the program, the rest is history! (let’s hope).

Summary: Do you really need a loyalty program?

If you have read up until here AND you were:

- A YES at the beginning, then hopefully the content has been valuable enough to keep you at a YES.

- A NO at the beginning but spent your valuable time reading up until here then perhaps your mind is open to the possibilities.

- If you were a NOT sure at the beginning, then hopefully the content has been valuable enough to get you closer to a YES (with motivation to help you continue on your quest).

The reality is a loyalty program is not for every brand with proof provided by the likes of Aldi, Chemist Warehouse, JB Hifi and Bunnings (except for Powerpass) and many others.

However for those with a program on their mind (or already in market), when you know why you need a program (your ‘why’ is clear - be it data, dialogue, dollars, advocacy, differentiator or new customers), the rest of the strategy will flow and benefits will be redeemed.

Have a happy loyalty day!

[1] Adam Posner’s definition of a loyalty program: “A defined structure (multi-variate) of ongoing benefits, rewards and recognition to enhance your customer’s life (financially, emotionally & with simplicity) in exchange for desired behaviours and beliefs for longer term profitable business growth (insights, income and advocacy)”.

[2] Adairs Annual report 2020 Director’s Report page 18 – “We have a large and loyal customer base with over 800,000 paid up members of our proprietary loyalty program, Linen Lovers. Linen Lover membership numbers continue to grow strongly each year (with a CAGR 14% of the last 3 years) and members are highly engaged — they visit Adairs more often and spend more each visit than non-members (accounting for 75% of Adairs sales)”

[3] Super Retail Group Limited Annual report 2020 CEO’s message page 4 – “CUSTOMER LOYALTY IS KEY . Our large, growing and loyal customer base continues to underpin our performance and provides us with a competitive advantage. We now have 6.6 million active club members across our four core brands and, together, these club members contributed 59 per cent of total sales.”

[4] MYER annual report 2020t: Page 6 MYER one – “The MYER one loyalty program has more than five million membership cards in circulation. We continue to work hard to reward our customers’ loyalty by providing engaging, personalised offers and exclusive experiences. MYER one customers are highly engaged in the program, accounting for almost two thirds of Myer sales, enabling Myer to reward our most loyal customers”

[5] Woolworths annual report 2020 – page 29 – “In Loyalty & FinTech, Everyday Rewards members grew by 5.5% to 12.3 million members by the end of June. In-store scan rates at Woolworths Supermarkets increased to 49.6% reflecting stronger member engagement.”

[6] Endeavour Drinks Group (Woolworths Group annual report 2020) – page 34: “My Dan’s loyalty program also continues to resonate with customers, with members reaching a record 4.5 million at the end of the year, an increase of 29% on the prior year”

[7] Australian Pharmaceuticals Industries Limited annual report 2020 – page 7 “Priceline has recently relaunched the Sister Club, which remains Australia’s largest health & beauty loyalty program. The changes to the platform are designed to grow sales and visitations by rewarding our most loyal customers.“

[8] Qantas annual report 2020 – page 21 “Qantas Loyalty reported an Underlying EBIT of $341 million, after reporting a record first half of 2019/20. It provided an important source of diversified earnings and positive cash flow as the Group’s airlines moved into hibernation”